IFRS Update

Why should you attend this course?

- You will refresh and deepen your knowledge and skills, particularly those relating to asset impairment, revenue recognition, leases and the consolidation of financial statements. All based on IFRS.

- The course is a workshop with examples and case studies, which means you will gain practical skills that you can immediately implement in your work.

Language of the course

Polish or English

Training level

advanced

Who is this course for?

- For those with existing knowledge of IFRS who wish to update and deepen their knowledge.

- For those involved in preparing or reading financial statements, in particular financial controllers, accountants, chief accountants and finance directors.

Course programme

- IAS 36 Impairment of assets: reasons for impairment review, scope of IAS 36, recoverable amount, impairment indicators, accounting for impairment in historical cost model and revaluation model, cash generating unit (CGU), order of impairment allocation in CGU, case studies

- IFRS 15 Revenue form contracts with customers: contract with a customer, components of a contract (performance obligations), establishing contract remuneration, allocation price to contract components, revenue recognition pattern, case studies

- IFRS 16 Leases: replacing IAS 17 by IFRS 16, key lease definitions, identifying a lease, right of use asset - measurement and presentation, lease liability – measurement and presentation, lessee accounting, optional recognition exemptions, case study

- Consolidated financial statements (IFRS 3, IFRS 10, IAS 28): reasons for preparation of Consolidated Financial Statements, definitions: control, subsidiary, parent, acquisition, 3 attributes of control, pre and postacquisition reserves, what is goodwill – purchased vs internally generated, goodwill calculate, fair value of identifiable net assets, fair value of consideration, impairment of Goodwill, non-controlling Interest, intra-group balances, intra-group sales, control vs significant influence, accounting for associates - balance sheet, accounting for associates – income statement, case study

"Well prepared course. Lots of useful information that I can use in my daily work."

From an opinion survey about the "IFRS update" course delivered in closed course format in March 2023.5,57/6

Average rating of tutors and course materials among participants of closed workshops for companies organised in 2023-2024."Effective and efficient course."

From an opinion survey about the "IFRS update" course delivered in closed course format in February 2023.97%

of all participants of the 2023-2024 tailored workshops for companies would recommend our training to their friends!

Open courses

Our open courses are short courses taught by experienced tutors whose role is to give you practical knowledge and skills that you can use immediately in your daily work.

It's a great opportunity to expand your knowledge and enhance your skills, whether you're motivated by an internal desire to develop or by your employer.

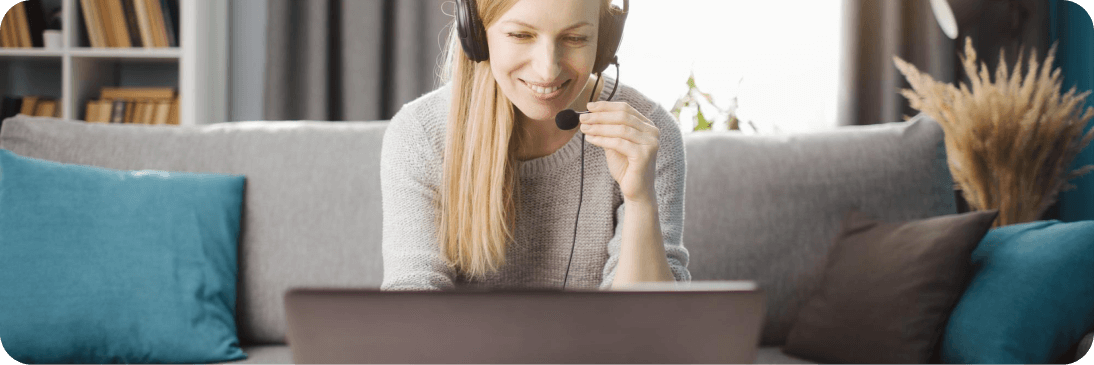

Bespoke programmes for companies

Does your team need training on this topic? Or, would your organization benefit from additional focus on specific issues in the course program, allowing some elements to be explored in greater depth?

With bespoke programs, we can adjust the training content to meet your organization’s specific needs. This includes adding topics not covered in the standard program or omitting sections less relevant to your team. The final cost of customized training is set individually at the proposal stage.